Title: Cryptocurrency wave travel: a beginner guide for long positions on bullish markets

Introduction

The world of cryptocurrencies has been in a rollercoaster walk in recent years, prices fluctuating wild from day to day. While some investors registered explosive yields, others have lost significant money. For those who are new on the market or look for profit ways, long positions can be an attractive strategy. In this article, we will explore how to adopt a crowded approach on cryptocurrency markets and provide strategies for making informed decisions.

What is a long position?

A long position in cryptocurrency means buying more a certain asset when trading over the present value, waiting to continue to rise in the price. This type of trade can be made on various exchanges, including Bitcoin (BTC), Ethereum (ETH) and others.

Characteristics of Bullish markets

Before you sink into strategies for long positions, consider what a Bullish market is doing:

* Increased demand : More people who buy cryptocurrency increase the general demand, pushing prices.

* Improved foundations : a stable or improving economy, government policies or technological progress can contribute to an upward trend.

* The stronger foundations : a clear understanding of the basic value of an asset and growth potential.

Strategies for Bullish markets

Now that we have covered the basic elements of Bullish markets, let’s explore a few strategies to make long positions in cryptocurrency:

1.

Position size

When entering a long position, it is essential to set a realistic budget. The size of the position is crucial to minimize the potential losses while maximizing the earnings.

* Start small : Start with a smaller investment and gradually increase as you gain confidence.

* Use stop losses : Set a price level that you are willing to sell if the market is reduced, limiting potential losses.

2.

Risk Management

To mitigate risks, it is essential to manage the risk effectively:

* Diversification : Spread -Investments in different cryptocurrencies or assets to minimize exposure.

* Stop Commands

: Set Automatic Stop Losses to your positions when reaching certain price levels.

3.

Technical analysis (TA)

Technical analysis provides information about market trends and models, helping to identify potential trading opportunities:

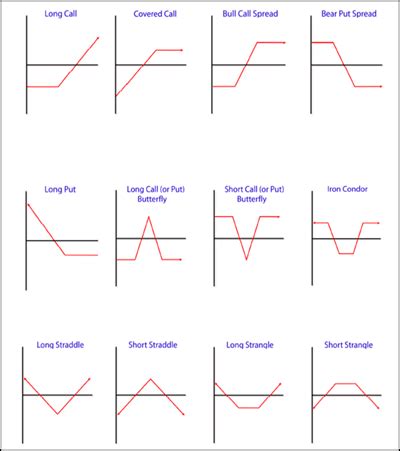

* Recognition of the graphic model : Diagram studies such as heads and shoulders, triangles or wedge to predict price movements.

* RSI (Relative Resistance Index) : RSI monitor to measure overlapping or surveillance conditions.

4.

Fundamental analysis

The fundamental analysis examines the basic value of an asset and the growth potential:

* Industry tendencies : research industry trends, market saturation and competition.

* Company performance : Evaluate the company’s finances, management team and product pipeline.

Example of trading strategy:

Here is a simple example of trading strategy for Bullish markets in cryptocurrency:

- Open a long position on Bitcoin (BTC) at $ 4,000, with a minimum investment of $ 100.

- Setați o comandă de stop-loss la 3.500 USD pentru a limita pierderile potențiale dacă prețul scade sub acest nivel.

- Use a profit order at $ 6,500 to block profits and get out of trade when prices reach this level.

Conclusion

The travel of the cryptocurrency wave can be an interesting experience for those who are willing to take calculated risks. By understanding Bullish markets and developing effective strategies for long positions, you will be better equipped to browse in the market ascents and downs. Always remember to stay informed, manage the risk and adapt to changing market conditions.