Understanding the risk of a currency exchange rate in cryptographic trade

Over the years, the world of cryptocurrencies has recorded rapid growth and variability, which makes it an investment opportunity for high risk for traders. One of the key aspects that should be taken into account when trading cryptocurrencies is the risk of exchange rates that can significantly affect your profits or losses. In this article, we delve into the risk of a exchange rate, its impact on cryptographic trade and how to alleviate it.

What is the risk of a exchange rate?

The risk of a currency exchange rate refers to fluctuations in the native value of cryptocurrency assets in relation to other cryptocurrencies and fiduat currencies due to changes in market demand, supply and economic conditions. By buying or selling cryptocurrency, you basically buy or sell its basic assets (e.g. Bitcoin, Ethereum) with a exchange rate that can change over time.

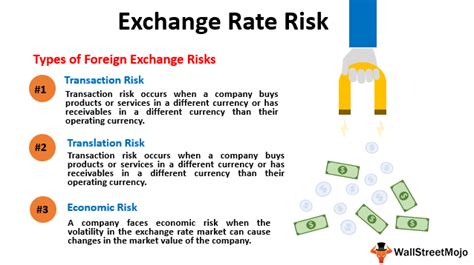

Types of the risk of the exchange rate

There are several types of risk of a currency exchange rate in cryptographic trade:

12

2.

3.

Impact of the risk of a currency exchange rate on cryptographic trade

The risk of a exchange rate can have a significant impact on trade results:

- losses : If the value of the basic assets (e.g. Bitcoin) decreases, increased exposure to the risk of a exchange rate, which leads to potential losses.

2.

- Value of time

: The value of money on money is affected by fluctuations in the exchange rate, which means that the purchase of assets at a lower price may be more favorable than waiting for its purchase later.

risk of limiting the exchange rate

To minimize the impact of the risk of a exchange rate on cryptographic trade:

1.

- Diversify your portfolio : Spread your investments into many cryptocurrencies to reduce the exposure to the price movements of each assets.

3.

- Set Stop-Loss levels : STOP-LOSS orders to limit potential losses if the value of the base assets drops significantly.

- Monitor market conditions

: keep monitoring market trends and adjust your strategy if necessary.

The best exchange rate management practices

To effectively manage the risk of a exchange rate:

1.

- Understand these risks before investing.

3.

4.

Application

The risk of a exchange rate is a key aspect of cryptographic trade that can significantly affect your profits or losses. Understanding the types of risk of the exchange rate, its impact on cryptographic trade and the best practices in relieving it, you can make more conscious investment decisions and reduce exposure to market fluctuations.