mastering the art of cryptocurrency spot trading with technical indicators

In the fast-paced world of cryptocurrency, Spot Trading has become a lucrative business opportunity. With its rapid growth and volatility, understanding technical indicators is crucial to make informed decisions about buying or selling cryptocurrencies. In this article, we’ll delve into the world of technical indicators and provide a step-by-step guide on how to use them for spot trading.

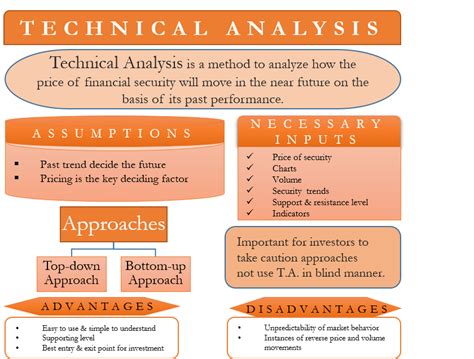

What are technical indicators?

Technical indicators are numerical values that help traders analyze price movements, trends, and patterns in various markets, including cryptocurrency. These indicators are calculated based on Historical Data and can be used to predict future market behavior. By applying technical indicators to cryptocurrency spot trading, traders can identify potential buying or selling opportunities and adjusting their positions accordingly.

Key Technical Indicators for Cryptocurrency Spot Trading

Here are some of the most popular technical indicators that traders use in cryptocurrency spot trading:

- Relative Strength Index (RSI) : Measures the speed and change of price movements to identify overbought or oversold conditions.

- Moving Averages (MA) : Combinations of Simple and Exponential Moving Averages that help smooth out price fluctuations and reveal trend direction.

- Bollinger Bands : plotting a range of price bars against an with helps traders gauge volatility and potential breakouts.

- Stochastic Oscillator : Evaluates the relationship between price and momentum to identify overbought or overbought.

- Ichimoku Cloud : provides a comprehensive view of market conditions, including support and resistance levels.

how to apply technical indicators for spot trading

To use technical indicators effectively in cryptocurrency spot trading, follow these steps:

- CHOOD THE RIGHT INDICATO : Select an indicator that aligns with your trading strategy and risk tolerance.

- Set a time frame : use a time frame that suits your market analysis needs, such as 4-hour, Daily, or weekly charts.

- plot the indicator : Display the chosen indicator on a chart to visualize price movements and patterns.

- Analyze the Chart : Study The Chart’s Performance Over Time to Identify Trends, Patterns, and Potential Breakouts.

- Use indicators in your trading strategy : Integrate Technical Indicators Into Your Trading Strategy by Setting Stop-Loss Levels, Entry Points, or Risk-Reward Ratios.

Example: Using RSI to Identify Overbought Conditions

Suppose you’re a day trader focusing on Bitcoin (BTC). You use the RSI indicator with an exponential moving average (EMA) of 50-Period to identify overbought conditions. Here’s how:

- Plot the BTC Price Chart with 4-Hour Time Frame.

- Set up the RSI indicator with EMA = 50 and calculate the RSI value.

- Identify a bearish crossover between the RSI line and the 50-Period ma, indicating overbought conditions.

If you see a significant drop in rsi values below 30, it may be a sign to close your position or set a stop-loss near the current price level. By using technical indicators in conjunction with other market analysis techniques, such as fundamental research and news feeds, traders can develop a more comprehensive trading strategy and increase their chances of success.

Conclusion

Technical indicators are a powerful tool for traders seeking to improve their cryptocurrency spot trading skills. By understanding how to apply various indicators effectively and combining them with fundamental analysis, traders can gain an edge in the market. Remember to always keep an eye on your emotions, risk management strategies, and adaptability as you navigate the rapidly evolving world of cryptocurrency trading.