Role of Market Signal in Dogecoin Formation: Exam

Dogecoin, a pseudonym crypto currency with a humorous community and a slogan of language in the cheek “No real value, but just for fun,” is known to experience wild prices. In recent years, Doga has varied between the lowest US $ 0.008 and high in the amount of over $ 0.30, leaving investors with confused and excited speculators.

One of the key factors that contributes to these unpredictable movements price is the presence of market signals in the cryptocurrency area. These signals can be identified as changes in market feelings, dealers’ behavior and external events that affect investor confidence. In this article, we will explore how market signals affect the prices of Doge and examine some of the most significant ones.

What are market signals?

Market signals relate to any change or event that affects the cryptocurrency market, such as shifts in the feeling of investors, an increase in the adoption of institutional players or an unexpected economic edition. These signals can be widely categorized in four types:

- Signals based on feelings

: changes in market mood and confidence among investors.

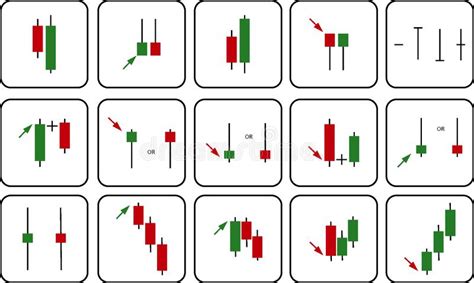

- Behavior signals : Merchant activity and shopping/sales forms.

- Signals based on events : external events that affect investor attitudes.

- Economic indicators : Economic data release, such as GDP or inflation rates.

Key market signals affecting the prices of Dogecoin

The cryptocurrency market has testified to numerous market signals that have affected the prices of Doge over the years. Here are some of the most significant:

- Pre-Ico Hype (2013) : Initial offer of coins (ICO) Dogecoin, launched in December 2013, created immensely hype and enthusiasm among investors.

- Increase to the main attention (2014-2015) : As Doge gained recognition from the main media and became presented in popular TV shows, its price increased significantly.

- Price bubble formation (2017) : Fast growth of the crypto market -van led to a temporary bubble of prices in 2017, which was fueled by increased adoption and guesses.

- Sales started by Short Squeeze (2018) : A sudden drop in the price of Dogea launched a sale of investors, which led to a sudden increase in the purchase activity because the traders moved to buy a coin.

- Market correction after the fall of the Crypto-wave (2020) : Global Pandemia COID-19 and Subsequent Economic Fall led to a significant crapto currency drop, including dogs, resulting in market correction.

Impact of market signals on the prices of Dogecoin

The presence of these market signals played a key role in shaping the price prices. Here are some examples:

- Price Volatility : Market signals have significantly contributed to the fluctuations of the prices that the reach has experienced.

- Support and resistance levels : on the phenomenon of support and resistance levels, such as $ 0.02 and $ 0.04, directly affects the market mood and behavior of traders.

- Investor confidence : A significant increase in investor trust is related to Bikovo Trend in Doge -Aa prices.

- Adoption and recognition of mainstream : Increased adoption of institutional players and the attention of the main media contributed to the increase in prices.

Conclusion

Market signals are a key component of the CRIPTO currency market, influencing the movement of the prices and formation of investors’ behavior. The presence of these signals has played a significant role in the formation of the doga price fluctuation over the years. As investors continue to adapt to the changes in the market, it is crucial to remain informed about the factors that start the prices of Doge.

Recommendations

In order to use potential prices movement, investors should:

- Be ongoing with market news : regularly monitor the market trends and feelings.

2.