Market Psychology: How Binance Coin (BNB) Influences Trading Strategies

Cryptocurrency markets have long been known for their high volatility and unpredictability, making it challenging to predict price movements with certainty. However, one player has emerged as a significant force in shaping market psychology – the cryptocurrency itself, specifically its underlying asset, Binance Coin (BNB). In this article, we will explore how BNB influences trading strategies and why investors should consider taking it into account when navigating the crypto markets.

What is Market Psychology?

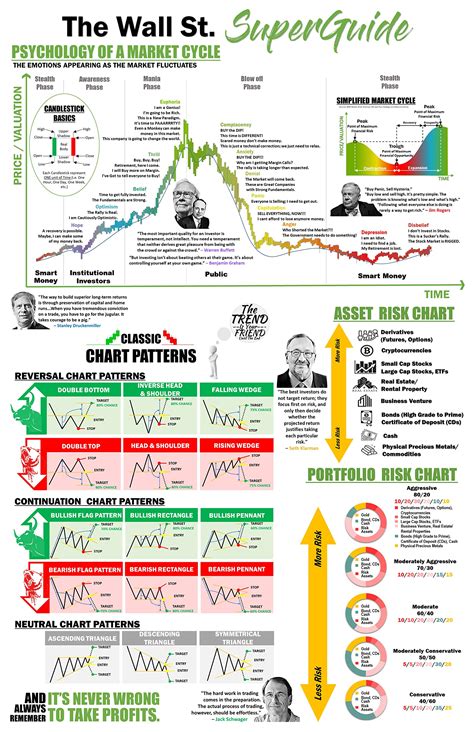

Market psychology refers to the study of how emotions and psychological factors influence investor behavior in financial markets. It encompasses various aspects, including risk tolerance, emotional decision-making, and herd behavior. In the context of cryptocurrency markets, market psychology plays a crucial role in shaping price movements and trading strategies.

The Rise of Binance Coin (BNB)

Binance Coin is the native cryptocurrency of the popular exchange Binance, one of the largest cryptocurrency platforms in the world. Launched in July 2017, BNB was designed to incentivize users to participate in the Binance ecosystem through a rewards program that offered discounts on trading fees and other benefits.

The success of Binance Coin can be attributed to its unique features:

- Decentralized Governance: BNB has a decentralized governance system, allowing token holders to vote on proposals for the future development and growth of Binance.

- Utility-based Token: Unlike some other cryptocurrencies that focus solely on speculation, BNB has real-world utility, such as discounts on trading fees, which appeals to users who want to reduce their costs.

- High Liquidity: Binance Coin has a high liquidity level, making it easier to trade and convert to other assets.

Market Psychology Influence

BNB’s influence on market psychology can be seen in several ways:

- Fear of Missing Out (FOMO): The high liquidity and attractive rewards system of BNB may lead some investors to take excessive risks, fearing they will miss out on potential gains if the price drops.

- Confirmation Bias: Investors who have already bought or sold BNB may be more likely to stick with their positions due to confirmation bias, where they interpret market movements as evidence of a strong trend.

- Emotional Decision-Making: The volatility and uncertainty of cryptocurrency markets can lead to emotional decision-making, such as panic buying or selling when prices seem to drop suddenly.

Trading Strategies

To effectively navigate the crypto markets with BNB in mind, traders should consider the following strategies:

- Dollar-Cost Averaging (DCA): Implement DCA to take advantage of buying and selling opportunities at lower prices, reducing the impact of FOMO.

- Stop-Loss Orders: Use stop-loss orders to limit potential losses when BNB falls below a certain price level.

- Position Sizing: Manage position sizes carefully to avoid excessive risks based on emotional decision-making.

- Market Sentiment Analysis: Monitor market sentiment and adjust trading strategies accordingly, taking into account the influence of BNB’s high liquidity and utility-based token features.

Conclusion

BNB has become a significant player in shaping market psychology in cryptocurrency markets. Its unique features and decentralized governance system have created an environment that attracts investors seeking real-world utility and attractive rewards. To effectively navigate these markets, traders should consider the psychological factors influencing investor behavior when making trading decisions. By doing so, they can optimize their strategies to minimize risks and maximize returns.