The importance of kyc in cryptocurrency trading

Cryptocurrencies have revolutionized the way people think about money and for a reason. Thanks to their ability to safely and anonymously, cryptocurrency opened new financial transactions that were previously impossible. However, with great power, great responsibility comes, and one of the most important elements of each cryptocurrency trade platform is the solid process of getting to know your client (KYC).

What is kyc?

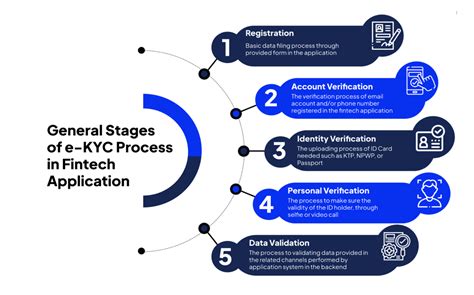

Kyc means “get to know your client”, which refers to the process of verifying the customer’s identity before he allows him to carry out financial transactions. In the context of cryptocurrency, KYC takes a number of steps that help identify and authenticate users who want to participate in commercial activities on the cryptocurrency exchange.

Why is KYC important in cryptocurrency trading?

Kyc is crucial for several reasons:

- Regulatory compatibility : Many countries have implemented regulations aimed at limiting money laundering and terrorist financing. To meet these provisions, exchanges must implement solid KYC measures to ensure that customers are authentic.

- Risk management : by verifying the identity of customers, exchanges can better manage the risk exposure. This includes the identification of suspicious actions, such as multiple transactions or shopping/sales of high value, which may indicate illegal activity.

- Security and protection : KYC helps prevent potential security violations, ensuring that only authorized customers have access to confidential information, such as private keys or portfolio addresses.

- Operational performance

: A well -established KYC process can improve the implementation of new users, reducing friction and increasing overall performance.

What are the key requirements of the KYC process?

To establish an important KYC process in cryptocurrency trade, exchanges must meet certain requirements:

- Customer registration : Exchange must require customers to register before allowing them to trade cryptocurrencies.

- Identity verification : stock exchanges may require customers to provide identification documents such as:

* Identifier issued by the government (e.g. driving license)

* Passport

* Proof of stay

- Address verification

: Exchange can verify the authenticity of customer addresses using techniques such as geolocalization of IP address or DNS search.

- Transaction history : Exchange may require customers to provide registration of their transactions, including:

* Portfolio activity (e.g. buy/sale/transfer)

* Payment methods used

- Risk assessment : Exchange should assess the level of risk of new users and implement funds to relieve potential losses.

The best practices for implementing KYC in cryptocurrency trade

To ensure a solid and compatible kyc process, exchanges can follow the best practices:

1.

- Use an advanced identity verification technique : Use advanced identity verification technologies such as biometric authentication or machine learning algorithms to improve safety.

- Employee school : Educate employees about the importance of kyc and make sure that they are familiar with the process and all changes in it.

- Customer activity : Regularly browse customer activity and transactions to detect suspicious behavior and take repair.

Application

To sum up, KYC is an indispensable element of cryptocurrency trade, serving as a critical check in relation to illegal activities, such as money laundering and terrorist financing.