Blockchain and Ai: A new era of financial innovation

The financial sector has long been at the forefront of technological innovation, and the recent progress of blockchain and artificial intelligence (AI) are no exception. These two emerging technologies transform how we carry out financial transactions, offering new ways for innovation and growth.

What is blockchain?

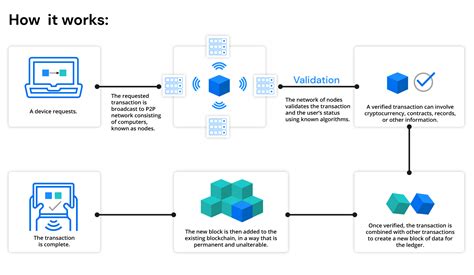

Blockchain is a decentralized digital register, which records transactions on several knots on a network. It allows the safe, transparent and resistant storage of data handling, which makes it an attractive solution for companies that want to improve their operational efficiency. Blockchain technology was developed for the first time by Satoshi Nakamoto in 2008 as a peer electronic cash system.

What is you?

Artificial intelligence refers to the development of computer systems that can perform tasks that usually require human intelligence, such as learning, solving problems and making decisions. AI has been around several decades, but has gained significant attention in recent years due to its potential to revolutionize industries in various sectors.

Intersection between Blockchain and Ai

Recent advances in blockchain technology have allowed the creation of decentralized applications (DAPP) that can use AI tools to improve their functionality. For example, a blockchain -based platform for managing cryptocurrency transactions could incorporate AI analyzes to predict market trends and optimize trading strategies.

Similarly, AI algorithms can be used to improve the efficiency of blockchain networks by automating tasks such as validation of data and discontinuation of transactions. This not only increases the processing speed, but also reduces the risk of errors or inconsistencies in blockchain.

Financial Innovation

The integration of blockchain and you have opened new ways for financial innovation. Some of the key domains in which these technologies are explored include:

- Decentralized Finance (Defi) : Defi Platforms based on Blockchain offer a number of financial services, such as loans, loans and trading, without the need for intermediaries.

- Automatic market mechanisms (AMM) : AMMs based on AI use automatic learning algorithms to optimize market volatility, reduce risk and increase liquidity.

- Predictive analytical : Blockchain -based platforms can incorporate AI -based analyzes to predict market trends, to identify patterns and to provide information to financial institutions.

- Identity checking : Blockchain -based identity verification solutions using Biometric AI -based authentication can improve the security and efficiency of different financial transactions.

Benefits and challenges

The integration of blockchain and you have both benefits and challenges. Some of the key advantages include:

* Increased efficiency

: Blockchain applications and you can automate many tasks, reducing the need for manual intervention and increasing the speed of transactions.

* Improved precision : AI -based analytical can provide more accurate predictions and perspectives, which leads to better decision -making in financial institutions.

* Improved security : Blockchain -based solutions use advanced cryptography and security measures to protect sensitive data.

However, there are also challenges associated with blockchain integration and AI:

* Regulatory frames : The regulatory landscape for blockchain and you continue to evolve and new frames must be established to ensure compliance.

* Scalability : Blockchain -based applications can be slow on scale due to the high calculation requirements of certain AI algorithms.

* Interoperability : Integration of different blockchain networks and AI solutions can be complex and requires significant technical expertise.