Understand the risk of trade in the Bear Market: What do you know before diving

For most merchants, the cryptocurrency market was volatile and unpredictable as prices quickly fluctuated in response to news and moods. While some investors have earned a lot of profit in the market market, many others have lost money or stopped. As the market continues to tend to decline, understanding of the risk of trade at the bear market is essential for anyone who wants to participate.

What is a bear market?

The bear market is a period when the overall result of the securities market is rapidly and significantly decreasing. In the meantime, investors are increasingly pessimistic about their future investment prospects, so they can sell their shares at low prices, hoping to sell at higher prices later. The bear’s market can last for months or even a year, with several examples, including 2008. The financial crisis, during which the stock markets fell from about 4,000 to 1000.

Risk associated with trade in the bear market

Trade in the bear market poses several unique risks that are not available in the bull market. Some basic risks include:

* Losses : The most obvious risks are high losses as prices can decrease quickly and investors can sell their shares at lower prices than they have bought.

* Liquidity : Liquidity is very important when trading in a bear market because prices can fluctuate quickly and investors have to be able to sell or buy quickly. However, if the market is becoming too ill, it can be difficult to quickly leave the position that causes further loss.

* Time degradation : The decomposition of time means losing value over time due to interest rates or other factors. In the bear market, this means that even low profits can be lost over time if investors do not sell their shares fast enough.

* volatility : volatility is another risk associated with trade in the bear market, as prices can fluctuate quickly and investors must be able to adapt quickly.

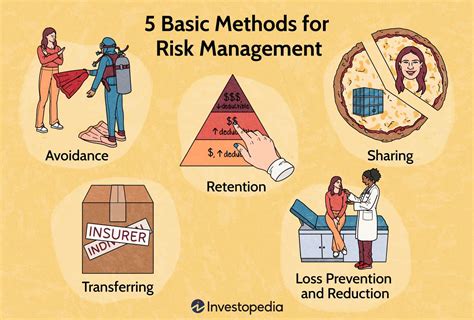

To soften the risk of trade in the bear market

Although there are no guarantees on the bear market, there are some steps that traders can take to mitigate the risk:

- Do your research : Before trading, make sure you understand the basic technology and market trends.

- Set clear goals : Before you start trading, clearly define your goals and tolerance for risk.

3.

- Increase your portfolio : Various of your portfolio can help reduce the impact of any particular market or sector.

- Be informed : Be informed of market trends and news to make more informed trading decisions.

Conclusion

Trading in the Bear Market is a high risk, high -value ambition to carefully consider and plan. Understanding the risks associated with trade in the bear market and taking measures to mitigate them, traders can reduce their losses and potential benefits from these volatile markets.